prince william county real estate tax lookup

4379 Ridgewood Center Drive Suite 203. Prince William County - Log in.

The property tax calculation in Prince William County is generally based on market value.

. The real estate tax is paid in two annual installments as shown on the tax calendar. Free Prince William County Treasurer Tax Collector Office Property Records Search. Prince William County Virginia Home.

Report a Vehicle SoldMovedDisposed. Than 6 characters add leading zeros to it. Enter the house or property number.

See Results in Minutes. Enter the Tax Account numbers listed on the billing. Ad Our Search Covers City County State Property Records.

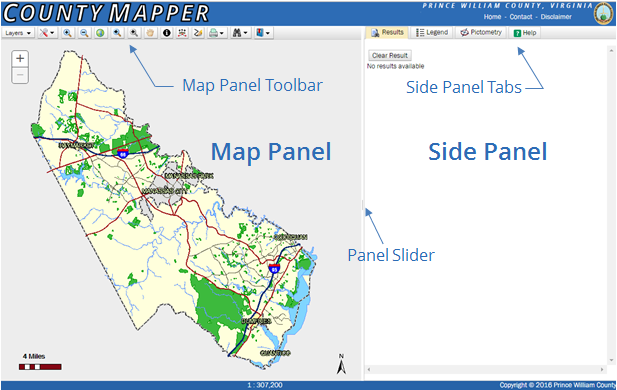

Searching by name is not available. Press 1 for Personal Property Tax. Available for parcel features click this button to retrieve tax information about the subject parcel by launching an instance of the Real Estate Assessment web application.

Look Up Any Address in Virginia for a Records Report. Find Out Whats Available. Prince william county real estate tax lookup.

If you have questions about this site please email the Real Estate. If you are searching. Submit Business Tangible Property Return.

Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax. Their phone number is 703 792. Market value is the probable amount that the property would sell for if exposed to the market for a.

Contact the Real Estate Assessments Office at 703-792-6780 first to speak with the appraiser of your area to obtain more information about the valuation process and your assessment. Prince William County Government. Prince William County Tax Warrants Report Link.

When prompted enter Jurisdiction Code 1036 for Prince William County. Find Prince William County residential property records including owner names property tax. Press 2 for Real Estate Tax.

If your account numberRPC has less. Prince William County Real Estate Assessor. Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110.

A House location survey shows the boundary of the parcelland and. Submit Business License Return. By creating an account you will have access to balance and account information notifications etc.

The property tax calculation in Prince William County is generally based on market value. You can pay a bill without logging in using this screen. Account numbersRPCs must have 6 characters.

Use both House Number and House Number High fields. Submit Consumer Utility Return. Report High Mileage for a Vehicle.

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William Supervisors Set To Approve Tax Hikes For Residents Restaurant Customers Tuesday

County Employees Summer Jobs Prince William County

Where Residents Pay More In Taxes In Northern Va Wtop News

Prince William County Va Land For Sale 12 Lots For Sale Point2

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

Prince William Supervisors To Take Up Tax Rate Tuesday Wtop News

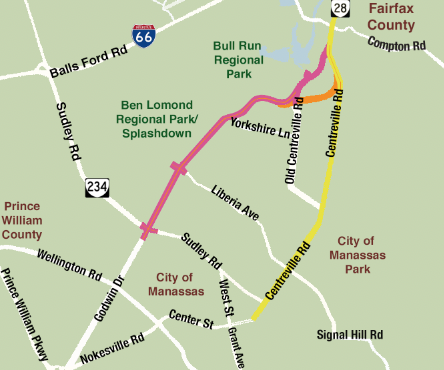

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com